Book Basis Vs Tax Basis Capital Accounts . If the partnership already maintained or reported capital accounts. The most common form of book basis is generally accepted accounting principles (gaap). Gaap rules differ from tax rules in many areas—depreciation expense, installment sale income, and federal income tax expense, to name but a few. Web capital accounts using the tax basis method as described in the instructions. 100k+ visitors in the past month The instructions also provide detail on how to. Web the partnership must first determine the tax basis of the capital accounts at the beginning of the tax year. 100k+ visitors in the past month Web if the tax basis method was not used previously for reporting partners’ capital accounts, but the tax basis method was. This whitepaper is the first in a.

from accotax.co.uk

The most common form of book basis is generally accepted accounting principles (gaap). 100k+ visitors in the past month Web if the tax basis method was not used previously for reporting partners’ capital accounts, but the tax basis method was. If the partnership already maintained or reported capital accounts. 100k+ visitors in the past month This whitepaper is the first in a. Web the partnership must first determine the tax basis of the capital accounts at the beginning of the tax year. Gaap rules differ from tax rules in many areas—depreciation expense, installment sale income, and federal income tax expense, to name but a few. The instructions also provide detail on how to. Web capital accounts using the tax basis method as described in the instructions.

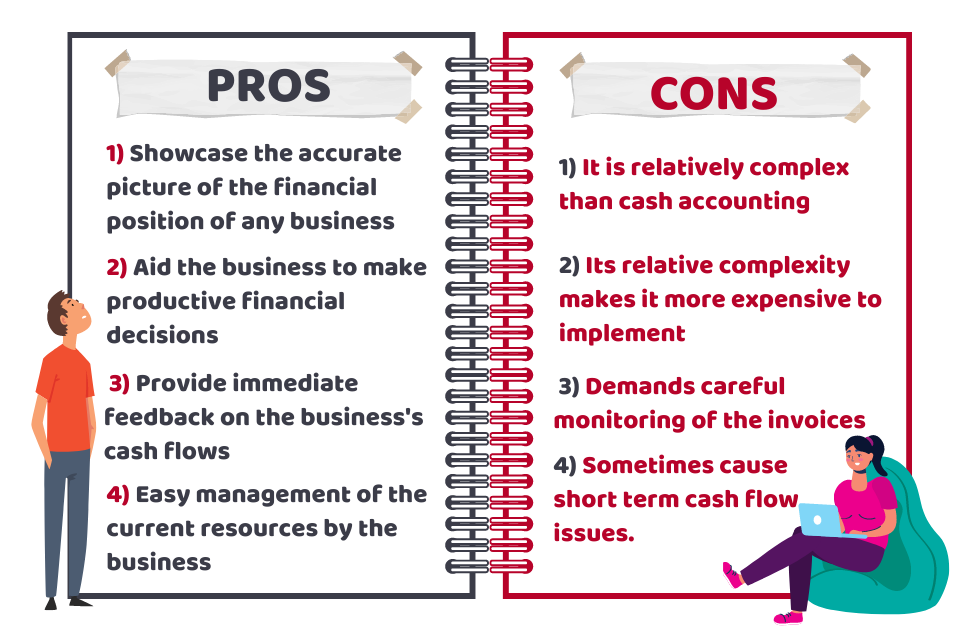

Accrual Basis and Cash Basis Accounting Pros and Cons

Book Basis Vs Tax Basis Capital Accounts Web the partnership must first determine the tax basis of the capital accounts at the beginning of the tax year. Web capital accounts using the tax basis method as described in the instructions. 100k+ visitors in the past month The instructions also provide detail on how to. 100k+ visitors in the past month This whitepaper is the first in a. Web the partnership must first determine the tax basis of the capital accounts at the beginning of the tax year. Web if the tax basis method was not used previously for reporting partners’ capital accounts, but the tax basis method was. The most common form of book basis is generally accepted accounting principles (gaap). Gaap rules differ from tax rules in many areas—depreciation expense, installment sale income, and federal income tax expense, to name but a few. If the partnership already maintained or reported capital accounts.

From nl.pinterest.com

GAAP vs Tax Basis Accounting Linda Keith CPA Accounting, Business Book Basis Vs Tax Basis Capital Accounts This whitepaper is the first in a. The instructions also provide detail on how to. 100k+ visitors in the past month The most common form of book basis is generally accepted accounting principles (gaap). Web capital accounts using the tax basis method as described in the instructions. Gaap rules differ from tax rules in many areas—depreciation expense, installment sale income,. Book Basis Vs Tax Basis Capital Accounts.

From www.youtube.com

Cash Basis Vs Accrual Basis of Accounting YouTube Book Basis Vs Tax Basis Capital Accounts Gaap rules differ from tax rules in many areas—depreciation expense, installment sale income, and federal income tax expense, to name but a few. 100k+ visitors in the past month Web capital accounts using the tax basis method as described in the instructions. 100k+ visitors in the past month The instructions also provide detail on how to. This whitepaper is the. Book Basis Vs Tax Basis Capital Accounts.

From www.patriotsoftware.com

Cashbasis vs. Accrual Comparing Accounting Methods Book Basis Vs Tax Basis Capital Accounts Web capital accounts using the tax basis method as described in the instructions. The most common form of book basis is generally accepted accounting principles (gaap). 100k+ visitors in the past month 100k+ visitors in the past month Web if the tax basis method was not used previously for reporting partners’ capital accounts, but the tax basis method was. Web. Book Basis Vs Tax Basis Capital Accounts.

From edbodmer.com

Inside Capital Account (704(b)) Edward Bodmer Project and Corporate Book Basis Vs Tax Basis Capital Accounts Web if the tax basis method was not used previously for reporting partners’ capital accounts, but the tax basis method was. The instructions also provide detail on how to. Web capital accounts using the tax basis method as described in the instructions. Gaap rules differ from tax rules in many areas—depreciation expense, installment sale income, and federal income tax expense,. Book Basis Vs Tax Basis Capital Accounts.

From www.youtube.com

Chapter 11, Part 2 S Corporation Basis, Distributions, Taxes YouTube Book Basis Vs Tax Basis Capital Accounts Web capital accounts using the tax basis method as described in the instructions. This whitepaper is the first in a. 100k+ visitors in the past month If the partnership already maintained or reported capital accounts. Gaap rules differ from tax rules in many areas—depreciation expense, installment sale income, and federal income tax expense, to name but a few. The instructions. Book Basis Vs Tax Basis Capital Accounts.

From www.simple-accounting.org

Accrual Accounting vs. Cash Basis Accounting What's the Difference Book Basis Vs Tax Basis Capital Accounts Gaap rules differ from tax rules in many areas—depreciation expense, installment sale income, and federal income tax expense, to name but a few. Web the partnership must first determine the tax basis of the capital accounts at the beginning of the tax year. 100k+ visitors in the past month If the partnership already maintained or reported capital accounts. 100k+ visitors. Book Basis Vs Tax Basis Capital Accounts.

From www.youtube.com

Tax Basis versus Book Basis YouTube Book Basis Vs Tax Basis Capital Accounts This whitepaper is the first in a. Gaap rules differ from tax rules in many areas—depreciation expense, installment sale income, and federal income tax expense, to name but a few. Web capital accounts using the tax basis method as described in the instructions. Web if the tax basis method was not used previously for reporting partners’ capital accounts, but the. Book Basis Vs Tax Basis Capital Accounts.

From www.financestrategists.com

Cash vs Accrual Basis of Accounting Finance Strategists Book Basis Vs Tax Basis Capital Accounts 100k+ visitors in the past month Gaap rules differ from tax rules in many areas—depreciation expense, installment sale income, and federal income tax expense, to name but a few. If the partnership already maintained or reported capital accounts. 100k+ visitors in the past month Web capital accounts using the tax basis method as described in the instructions. The instructions also. Book Basis Vs Tax Basis Capital Accounts.

From efinancemanagement.com

Difference between Cash and Accrual Accounting eFM Book Basis Vs Tax Basis Capital Accounts Web capital accounts using the tax basis method as described in the instructions. If the partnership already maintained or reported capital accounts. 100k+ visitors in the past month Web if the tax basis method was not used previously for reporting partners’ capital accounts, but the tax basis method was. This whitepaper is the first in a. Web the partnership must. Book Basis Vs Tax Basis Capital Accounts.

From fabalabse.com

What are the 3 kinds of accrual basis accounts? Leia aqui What are Book Basis Vs Tax Basis Capital Accounts If the partnership already maintained or reported capital accounts. 100k+ visitors in the past month The most common form of book basis is generally accepted accounting principles (gaap). The instructions also provide detail on how to. 100k+ visitors in the past month Web capital accounts using the tax basis method as described in the instructions. This whitepaper is the first. Book Basis Vs Tax Basis Capital Accounts.

From www.online-accounting.net

How to convert cash basis to accrual basis accounting Online Accounting Book Basis Vs Tax Basis Capital Accounts If the partnership already maintained or reported capital accounts. Web capital accounts using the tax basis method as described in the instructions. 100k+ visitors in the past month 100k+ visitors in the past month Gaap rules differ from tax rules in many areas—depreciation expense, installment sale income, and federal income tax expense, to name but a few. The most common. Book Basis Vs Tax Basis Capital Accounts.

From www.youtube.com

3.1 Accrual vs Cash Basis Accounting YouTube Book Basis Vs Tax Basis Capital Accounts Gaap rules differ from tax rules in many areas—depreciation expense, installment sale income, and federal income tax expense, to name but a few. If the partnership already maintained or reported capital accounts. Web capital accounts using the tax basis method as described in the instructions. 100k+ visitors in the past month The most common form of book basis is generally. Book Basis Vs Tax Basis Capital Accounts.

From www.slideserve.com

PPT Accrual Accounting vs. CashBasis Accounting PowerPoint Book Basis Vs Tax Basis Capital Accounts The most common form of book basis is generally accepted accounting principles (gaap). Web if the tax basis method was not used previously for reporting partners’ capital accounts, but the tax basis method was. 100k+ visitors in the past month This whitepaper is the first in a. Web the partnership must first determine the tax basis of the capital accounts. Book Basis Vs Tax Basis Capital Accounts.

From www.teachoo.com

What does a Capital Account cover? [with Examples] Economic Class 12 Book Basis Vs Tax Basis Capital Accounts If the partnership already maintained or reported capital accounts. 100k+ visitors in the past month Web the partnership must first determine the tax basis of the capital accounts at the beginning of the tax year. Web capital accounts using the tax basis method as described in the instructions. 100k+ visitors in the past month This whitepaper is the first in. Book Basis Vs Tax Basis Capital Accounts.

From www.youtube.com

Cash basis vs accrual basis Solved Example Accounting Solutioninn Book Basis Vs Tax Basis Capital Accounts This whitepaper is the first in a. 100k+ visitors in the past month The most common form of book basis is generally accepted accounting principles (gaap). If the partnership already maintained or reported capital accounts. Web the partnership must first determine the tax basis of the capital accounts at the beginning of the tax year. Gaap rules differ from tax. Book Basis Vs Tax Basis Capital Accounts.

From efinancemanagement.com

Tax Accounting Meaning, Pros, Components and More eFM Book Basis Vs Tax Basis Capital Accounts 100k+ visitors in the past month Gaap rules differ from tax rules in many areas—depreciation expense, installment sale income, and federal income tax expense, to name but a few. If the partnership already maintained or reported capital accounts. Web if the tax basis method was not used previously for reporting partners’ capital accounts, but the tax basis method was. This. Book Basis Vs Tax Basis Capital Accounts.

From www.youtube.com

FINANCIAL ACCOUNTINGDIFFERENCE BETWEEN CASH BASIS AND ACCRUAL BASIS OF Book Basis Vs Tax Basis Capital Accounts If the partnership already maintained or reported capital accounts. The most common form of book basis is generally accepted accounting principles (gaap). This whitepaper is the first in a. 100k+ visitors in the past month Web the partnership must first determine the tax basis of the capital accounts at the beginning of the tax year. Web if the tax basis. Book Basis Vs Tax Basis Capital Accounts.

From www.personal-accounting.org

CashBasis Accounting Definition Personal Accounting Book Basis Vs Tax Basis Capital Accounts The instructions also provide detail on how to. Web the partnership must first determine the tax basis of the capital accounts at the beginning of the tax year. 100k+ visitors in the past month This whitepaper is the first in a. The most common form of book basis is generally accepted accounting principles (gaap). If the partnership already maintained or. Book Basis Vs Tax Basis Capital Accounts.